Enova Reports Second Quarter 2022 Results

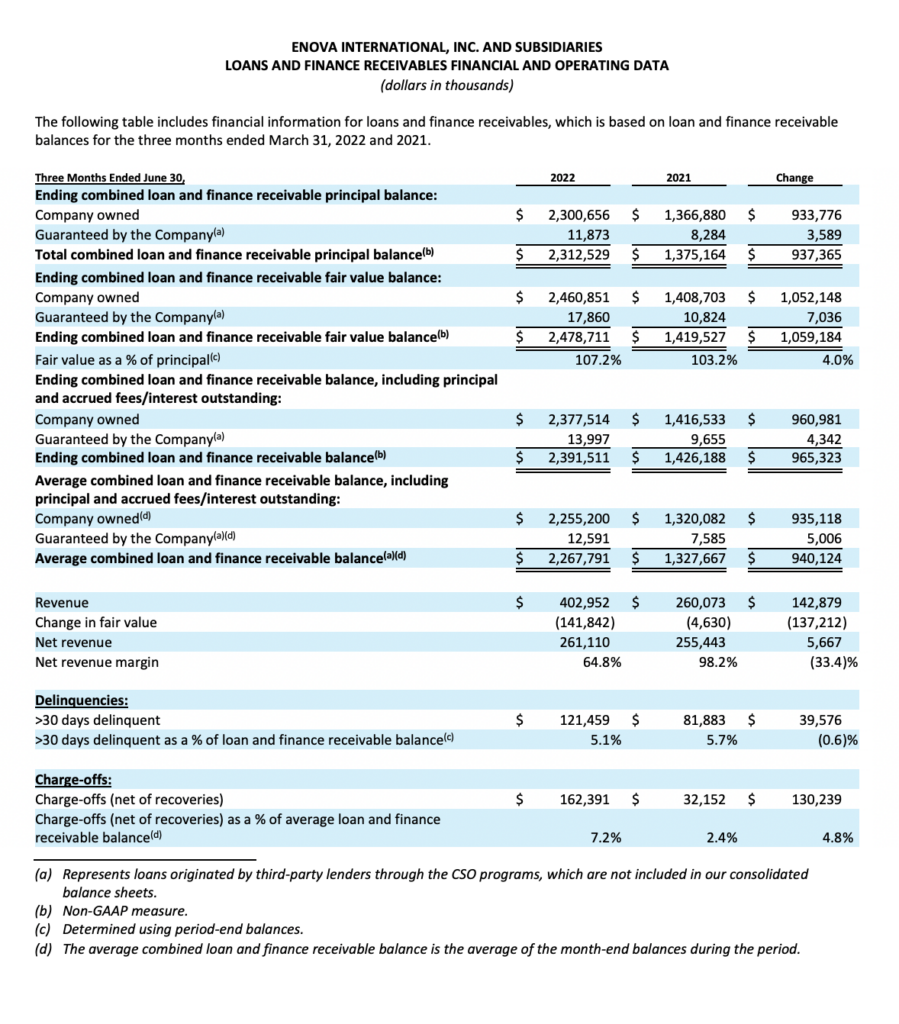

- Total revenue increased 6% sequentially in the second quarter of 2022 and 54% from the second quarter of 2021 to $408 million

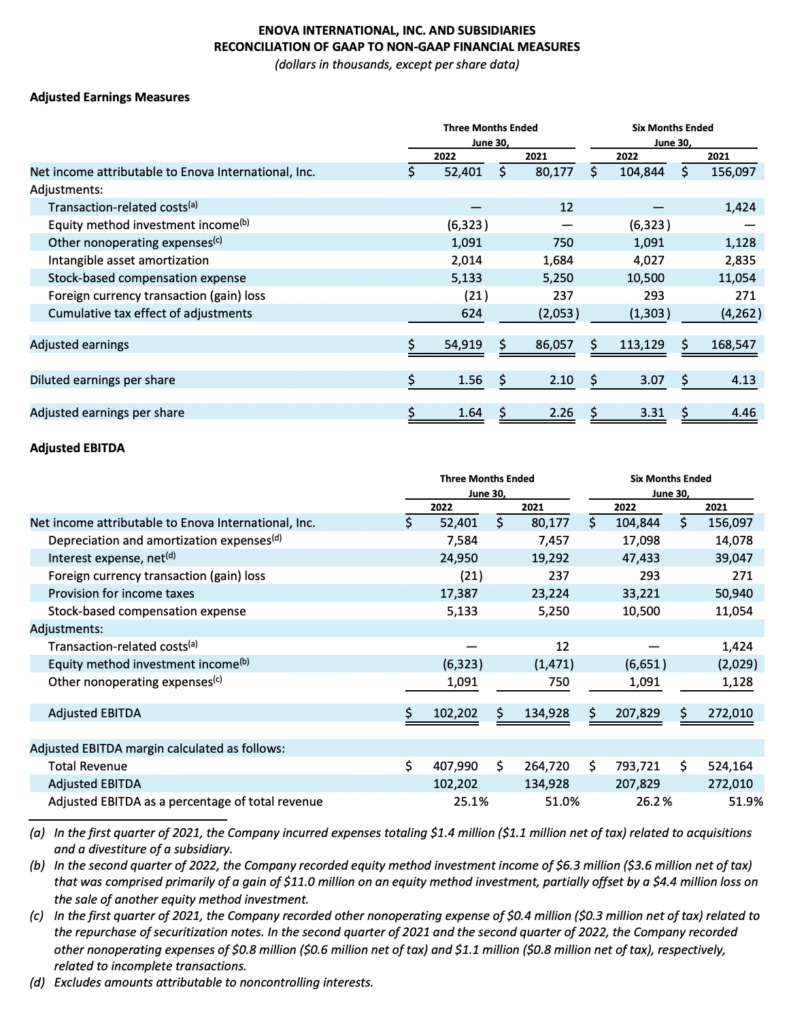

- Strong second quarter profitability with diluted earnings per share of $1.56 and adjusted earnings per share of $1.64

- Total company originations were $1.1 billion, 5% higher sequentially

- Continued strong credit performance with consolidated portfolio net charge-offs as a percentage of average combined loan and finance receivables of 7.2% in the second quarter of 2022, compared to 7.6% in the first quarter of 2022

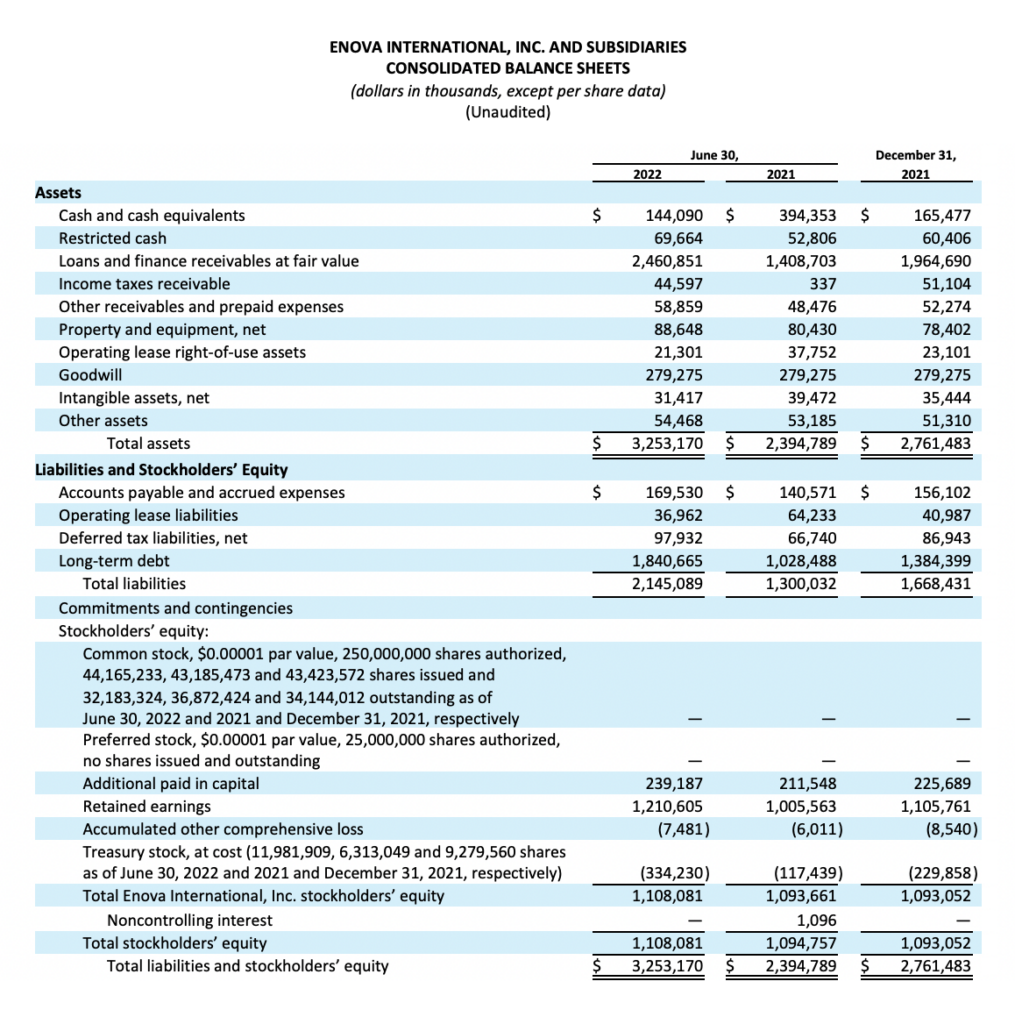

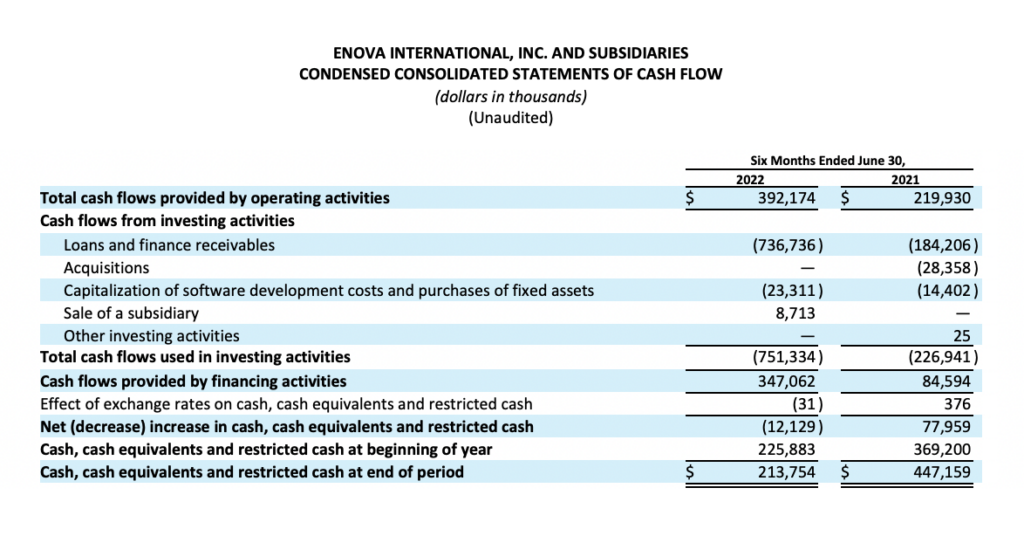

- At June 30, total liquidity exceeded $1 billion, including cash and marketable securities of $232 million and available capacity on committed facilities of $803 million

- Acquired approximately 743 thousand shares during the second quarter under the company’s share repurchase program

CHICAGO, July 28, 2022 /PRNewswire/ — Enova International (NYSE: ENVA), a leading financial technology company powered by machine learning and artificial intelligence, today announced financial results for the second quarter ended June 30, 2022.

“We are pleased to report continued strong loan growth and solid credit metrics across our portfolio,” said David Fisher, Enova’s Chief Executive Officer. “We have successfully demonstrated our ability to quickly adapt to changes, including shifting macro-economic conditions. We continue to see strength in consumers and small businesses as high employment and rising wages provides an ideal backdrop for solid credit performance. Looking forward, we are confident that our highly flexible, online-only business model and well-diversified portfolio positions us well to continue to drive profitable growth while also effectively managing risk.”

Second Quarter 2022 Summary

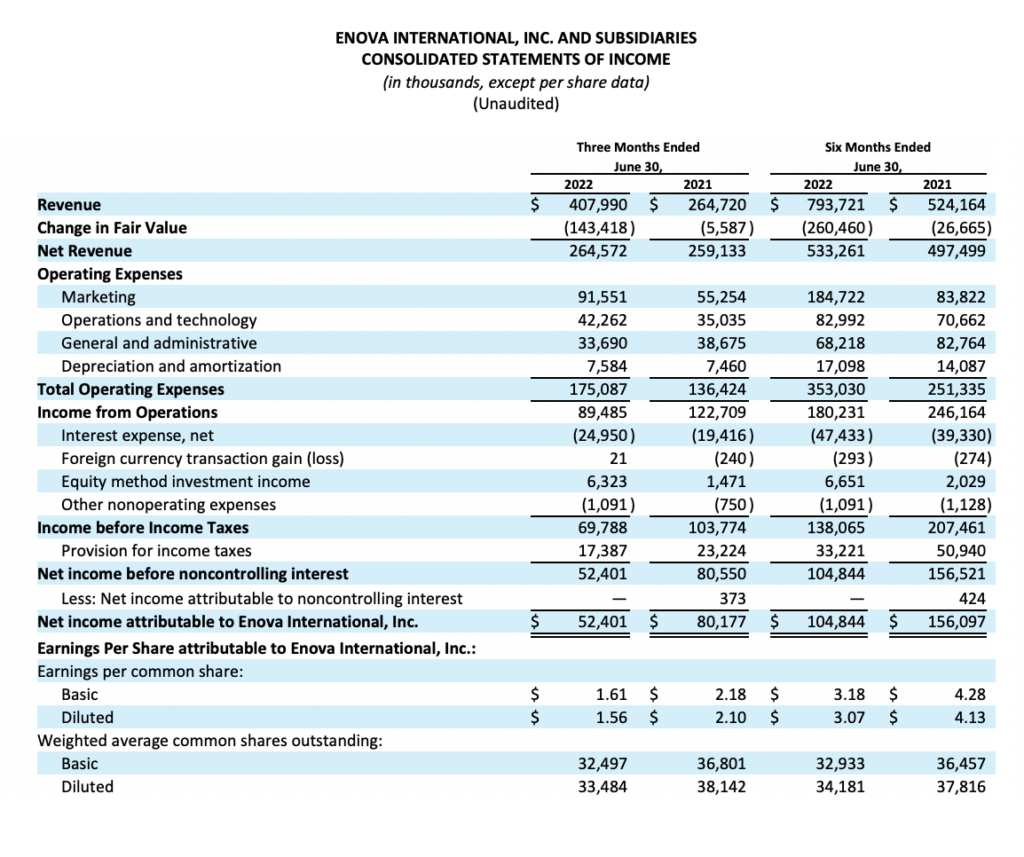

- Total revenue of $408 million in the second quarter of 2022 increased 54% from $265 million in the second quarter of 2021.

- Net revenue margin of 65% in the second quarter of 2022 compared to 98% in the second quarter of 2021.

- Net income attributable to Enova International, Inc. of $52 million, or $1.56 per diluted share, in the second quarter of 2022 compared to $80 million, or $2.10 per diluted share, in the second quarter of 2021.

- Second quarter 2022 adjusted EBITDA, a non-GAAP measure, of $102 million compared to $135 million in the second quarter of 2021.

- Adjusted earnings of $55 million, or $1.64 per diluted share, both non-GAAP measures, in the second quarter of 2022 compared to adjusted earnings of $86 million, or $2.26 per diluted share, in the second quarter of 2021.

“As we have moved into a normalized post-pandemic economy, we have continued to grow our portfolio with attractive unit economics,” said Steve Cunningham, CFO of Enova. “Additionally, we meaningfully increased our funding capacity during the quarter at attractive terms and now have more than $1 billion in available liquidity. Our solid balance sheet gives us the financial flexibility to successfully navigate a range of operating environments and to continue to deliver on our commitment to long-term shareholder value through both continued investments in our business as well as share repurchases.”

For information regarding the non-GAAP financial measures discussed in this release, please see “Non-GAAP Financial Measures” and “Reconciliation of GAAP to Non-GAAP Financial Measures” below.

Conference Call

Enova will host a conference call to discuss its second quarter 2022 results at 4 p.m. Central Time / 5 p.m. Eastern Time today, July 28th. The live webcast of the call can be accessed at the Enova Investor Relations website at http://ir.enova.com, along with the company’s earnings press release and supplemental financial information. The U.S. dial-in for the call is 1-855-560-2575 (1-412-542-4161 for non-U.S. callers). Please ask to join the Enova International call. A replay of the conference call will be available until August 4, 2022, at 10:59 p.m. Central Time / 11:59 p.m. Eastern Time, while an archived version of the webcast will be available on the Enova International Investor Relations website for 90 days. The U.S. dial-in for the conference call replay is 1-877-344-7529 (1-412-317-0088). The replay access code is 3569902.

About Enova

Enova International (NYSE: ENVA) is a leading financial technology company providing online financial services through its artificial intelligence and machine learning powered lending platform. Enova serves the needs of non-prime consumers and small businesses, who are frequently underserved by traditional banks. Enova has provided more than 7 million customers with over $40 billion in loans and financing with market leading products that provide a path for them to improve their financial health. You can learn more about the company and its brands at www.enova.com.

SOURCE Enova International, Inc.

For further information:

Public Relations Contact:

Kaitlin Lowey

Email: media@enova.com

Investor Relations Contact:

Lindsay Savarese

Office: (212) 331-8417

Email: IR@enova.com

Monica Gould

Office: (212) 871-3927

Email: IR@enova.com

Cautionary Statement Concerning Forward Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the business, financial condition and prospects of Enova. These forward-looking statements give current expectations or forecasts of future events and reflect the views and assumptions of Enova’s senior management with respect to the business, financial condition and prospects of Enova as of the date of this release and are not guarantees of future performance. The actual results of Enova could differ materially from those indicated by such forward-looking statements because of various risks and uncertainties applicable to Enova’s business, including, without limitation, those risks and uncertainties indicated in Enova’s filings with the Securities and Exchange Commission (“SEC”), including our annual report on Form 10-K, quarterly reports on Forms 10-Q and current reports on Forms 8-K. These risks and uncertainties are beyond the ability of Enova to control, and, in many cases, Enova cannot predict all of the risks and uncertainties that could cause its actual results to differ materially from those indicated by the forward-looking statements. When used in this release, the words “believes,” “estimates,” “plans,” “expects,” “anticipates” and similar expressions or variations as they relate to Enova or its management are intended to identify forward-looking statements. Enova cautions you not to put undue reliance on these statements. Enova disclaims any intention or obligation to update or revise any forward-looking statements after the date of this release.

Non-GAAP Financial Measures

In addition to the financial information prepared in conformity with generally accepted accounting principles, or GAAP, Enova provides historical non-GAAP financial information. Management believes that presentation of non-GAAP financial information is meaningful and useful in understanding the activities and business metrics of Enova’s operations. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of Enova’s business that, when viewed with its GAAP results, provide a more complete understanding of factors and trends affecting its business.

Management provides non-GAAP financial information for informational purposes and to enhance understanding of Enova’s GAAP consolidated financial statements. Readers should consider the information in addition to, but not instead of or superior to, Enova’s financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

Combined Loans and Finance Receivables

The combined loans and finance receivables measures are non-GAAP measures that include loans and finance receivables that Enova owns or has purchased and loans that Enova guarantees. Management believes these non-GAAP measures provide investors with important information needed to evaluate the magnitude of potential receivable losses and the opportunity for revenue performance of the loans and finance receivable portfolio on an aggregate basis. Management also believes that the comparison of the aggregate amounts from period to period is more meaningful than comparing only the amounts reflected on Enova’s consolidated balance sheet since revenue is impacted by the aggregate amount of receivables owned by Enova and those guaranteed by Enova as reflected in its consolidated financial statements.

Adjusted Earnings Measures

In addition to reporting financial results in accordance with GAAP, Enova has provided adjusted earnings and adjusted earnings per share, or, collectively, the Adjusted Earnings Measures, which are non-GAAP measures. Management believes that the presentation of these measures provides investors with greater transparency and facilitates comparison of operating results across a broad spectrum of companies with varying capital structures, compensation strategies, derivative instruments and amortization methods, which provides a more complete understanding of Enova’s financial performance, competitive position and prospects for the future. Management also believes that investors regularly rely on non-GAAP financial measures, such as the Adjusted Earnings Measures, to assess operating performance and that such measures may highlight trends in Enova’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. In addition, management believes that the adjustments shown below are useful to investors in order to allow them to compare Enova’s financial results during the periods shown without the effect of each of these expense items.

Adjusted EBITDA Measures

In addition to reporting financial results in accordance with GAAP, Enova has provided Adjusted EBITDA and Adjusted EBITDA margin, or, collectively, the Adjusted EBITDA measures, which are non-GAAP measures. Adjusted EBITDA is a non-GAAP measure that Enova defines as earnings excluding depreciation, amortization, interest, foreign currency transaction gains or losses, taxes and stock-based compensation. In addition, management believes that the adjustments for transaction-related costs, other nonoperating expenses and equity method investment income shown below are useful to investors in order to allow them to compare our financial results during the periods shown without the effect of the expense items. Adjusted EBITDA margin is a non-GAAP measure that Enova defines as Adjusted EBITDA as a percentage of total revenue. Management believes Adjusted EBITDA Measures are used by investors to analyze operating performance and evaluate Enova’s ability to incur and service debt and Enova’s capacity for making capital expenditures. Adjusted EBITDA Measures are also useful to investors to help assess Enova’s estimated enterprise value.